Voya Financial (VOYA)·Q4 2025 Earnings Summary

Voya Financial Q4 2025 Earnings: Double Beat, But Stock Dips 2.6% as Stop Loss Reserves Rise

February 4, 2026 · by Fintool AI Agent

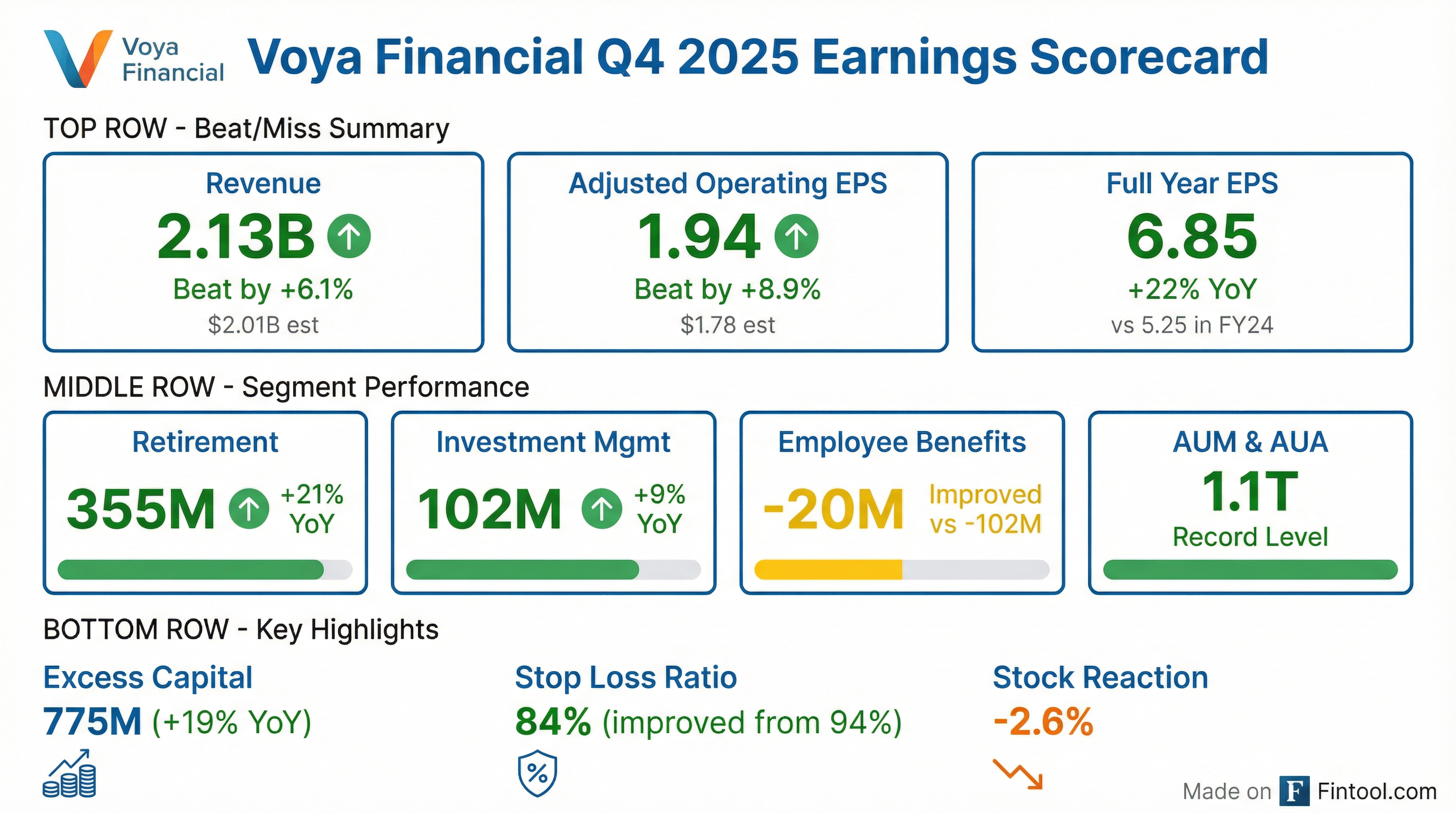

Voya Financial delivered a strong Q4 2025, beating both revenue and earnings expectations while posting record full-year results. Revenue came in at $2.13 billion, 6.1% above consensus, while Adjusted Operating EPS of $1.94 topped estimates by 8.9%. Full-year 2025 Adjusted Operating EPS reached $8.85, up 22% from $7.25 in FY24.

Despite the beat, shares fell 2.6% as management disclosed increased Stop Loss reserves to better navigate the 2026 healthcare environment — a signal that margin pressure may persist in the Employee Benefits segment.

Did Voya Beat Earnings?

Yes, Voya beat on both revenue and EPS.

Values from S&P Global estimates

For the full year, Voya exceeded $1 billion in pre-tax Adjusted Operating Earnings for the first time, reaching $1.038 billion. This marks 8 consecutive quarters of EPS beats.

Beat/Miss History (Last 8 Quarters)

Values from S&P Global estimates

How Did the Stock React?

Despite the double beat, VOYA fell 2.6% on earnings day, closing at $75.52 vs. the previous close of $77.45. The stock has still gained 9.1% year-to-date from $69.24 at the start of 2025.

Values retrieved from S&P Global

The sell-off appears driven by the Stop Loss reserve increase disclosed in the quarter. Management proactively built reserves to "better navigate the 2026 healthcare landscape," signaling potential claims volatility ahead.

What Changed From Last Quarter?

Positive Developments

-

Record AUM Milestone: Combined Retirement and Investment Management assets surpassed $1 trillion for the first time, driven by record organic Defined Contribution net inflows of $28.2 billion and the OneAmerica acquisition.

-

Stop Loss Margin Recovery: Full-year Stop Loss loss ratio improved to 84% from 94% in FY24, a significant turnaround from the challenging 2024.

-

OneAmerica Integration Exceeding Expectations: The acquired business contributed revenue and earnings ahead of plan.

-

Excess Capital Generation: $775 million generated in FY25, up 19% YoY and above the company's 90% free cash flow conversion target.

Areas of Concern

-

Stop Loss Reserve Build: Q4'25 includes increased reserves for Stop Loss, signaling management caution about 2026 claims.

-

Employee Benefits Operating Loss: The segment posted a -$10 million adjusted operating loss in Q4, though significantly improved from -$102 million in Q4'24.

-

In-Force Premium Decline: Employee Benefits annualized in-force premiums fell 5% YoY as management prioritized margin over growth.

Segment Performance

Retirement: Firing on All Cylinders

Retirement delivered record results, with FY25 pre-tax earnings of $959 million, up 17% YoY. Key drivers:

- Record net inflows: $28.2 billion in organic Defined Contribution net inflows

- OneAmerica: Added $60 billion of assets on day one

- Total client assets: $797 billion, up 30% YoY

Investment Management: Record Revenue

Investment Management achieved record net revenues exceeding $1 billion for the first time in firm history. Key metrics:

- Record net inflows: $14.6 billion (4.8% organic growth)

- AUM: $360 billion, up from $339 billion at year-end 2024

- Operating margin: 28.3%, consistent with prior year

Employee Benefits: Margin Focus

While still posting a Q4 loss, Employee Benefits showed meaningful improvement:

- FY25 earnings: $152 million vs. $40 million in FY24

- Stop Loss loss ratio: 84% vs. 94% in FY24

- Jan-26 renewals: 24% average net effective rate increase, prioritizing margin over growth

What Did Management Say?

CEO Heather Lavallee on the full-year results:

"We delivered strong results in 2025, exceeding our targets for adjusted pre-tax earnings and cash generation, reflecting the strength of our diversified businesses, our disciplined execution, and the focus on our customers."

On the $1 trillion AUM milestone:

"Leveraging the strengths and connections across our Retirement, Investment Management and Employee Benefits businesses continues to support our growth and enhance the value we deliver for our customers, evidenced by our Retirement and Investment Management AUM surpassing $1 trillion in assets in the year."

On 2026 outlook:

"Our strong free-cash-flow generation and continued work to align our solutions with the evolving needs of employers, employees and intermediaries positions us to enter the year with solid momentum and a clear set of priorities."

On Stop Loss strategic value:

"This is a very important product in our overall portfolio... There is much greater demand and lower supply. So we think we're in a well-positioned spot, specifically demonstrated by the 24% rate increase we achieved on the book while maintaining the block size."

Capital Return & Balance Sheet

Balance sheet remains strong:

- Excess capital: ~$0.4 billion

- RBC ratio: 413% (above 375% target)

- Financial leverage: 27.0% (within 25-30% target)

- Remaining buyback authorization: $562 million

Key Metrics Summary

2026 Priorities

Management outlined clear priorities for 2026:

- Grow excess cash generation — Build on the $775M generated in 2025

- Maintain strong balance sheet and capital flexibility — Keep leverage within 25-30% target

- Drive commercial momentum in Retirement and Investment Management

- Further improve margins in Employee Benefits — Continue Stop Loss repricing discipline

Q&A Highlights: What Analysts Asked

Stop Loss Reserve Deep Dive

Analysts pressed hard on the Stop Loss reserve build. CFO Mike Katz disclosed a $37 million reserve increase in Q4 and explained the January 2025 cohort is showing a 91% loss ratio vs. the 84% full-year reported figure.

Key context from the call:

"The range of outcomes today is different than what I would say historically for stop loss. You hear us talk about 77%-80%, a three-point range. But with this healthcare backdrop, that range is wider, probably double the normal range."

When pressed for paid claims data, Katz offered a quantitative benchmark:

"We're saying it's modestly better... You should be thinking low single digits better on a paid claim basis from where we were a year ago to today."

On the healthcare trends driving volatility:

"We're seeing the same themes with respect to higher frequency related to cancer, particularly at younger ages. We're seeing the higher severity from a cell and gene therapy perspective."

AI Strategy & Tech Exposure

Alex Scott (Barclays) asked about both AI opportunities and portfolio exposure. CEO Lavallee emphasized:

"Our focus is on leveraging AI to improve client experience, to help us drive efficiencies, and to support scale and growth. We're deploying it right now across a number of areas within our claims organization, within our contact center, certainly within technology."

On balance sheet exposure to AI/tech disruption, Voya appears well-insulated:

- General account tech exposure: ~1% of portfolio (software ~0.5%)

- High yield tech: "Nearly zero"

- Private portfolio tech: <1%

M&A Outlook: High Bar, But Active

When asked about retirement roll-ups following OneAmerica, CEO Lavallee signaled ongoing appetite:

"The retirement industry continues to be in secular consolidation. And we're viewed as a natural buyer... We're actively assessing opportunities. We think that there is a number of opportunities that we can pursue."

However, she maintained a high bar: buybacks remain the best near-term use of capital, with $150 million planned for Q1 and Q2 each.

Leave Solution Launch: Early Momentum

Management highlighted the January 2026 launch of their Integrated Leave and Disability Claim Solution, noting:

"Over 50% of the Group Life, disability, and supplemental health RFPs for 1Q 2026 were bundled with leave. It's a really positive sign given the investment and the commitment we've made to the space."

Investment Management 2026 Outlook

Matt Toms (CEO, Investment Management) outlined expectations:

"Longer term, we continue to think about that 2%+ organic growth rate assumption. We enter 2026 with momentum that has allowed us to grow above that. And we do expect the first quarter to be positive with good breadth across the domestic market."

Key Risks to Watch

-

Stop Loss Claims Volatility: The $37M reserve increase and 91% cohort loss ratio (vs 84% reported) signal uncertainty about 2026 healthcare costs. The range of outcomes is "double the normal range." Management's 24% rate increase may not fully offset claims if trends worsen.

-

Corporate Expense Pressure: Corporate segment losses expanded significantly due to performance-based compensation accruals, which could persist if results stay strong.

-

Market Sensitivity: ~$65-90M pre-tax earnings impact from a 10% S&P 500 move, with Investment Management and Retirement most exposed.

-

Interest Rate Sensitivity: +/- $15-35M pre-tax impact from 100bps rate change.

The Bottom Line

Voya delivered an exceptional 2025, exceeding both earnings and cash generation targets while crossing the $1 trillion AUM milestone. The 22% YoY growth in Adjusted Operating EPS to $8.85 reflects strong execution across all three business segments, successful integration of OneAmerica, and a meaningful turnaround in Stop Loss margins.

The stock's 2.6% decline despite the beat reflects investor caution around the Stop Loss reserve build and uncertainty about 2026 healthcare claims. However, with an 18.6% ROE, 90% free cash flow conversion, and significant buyback capacity remaining, Voya enters 2026 from a position of strength.

Earnings call held February 4, 2026. Full transcript now available.

Related Links: